|

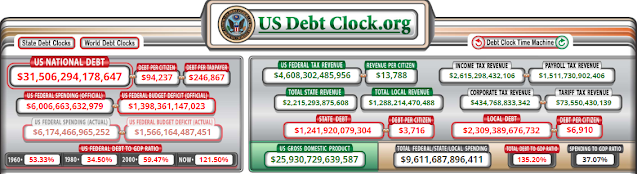

| US Debt Clock as of 23/01/2023 |

The question of whether or not the United States will collapse due to high debt is a complex and controversial one. Some experts argue that the country's high debt levels could lead to a financial crisis, while others argue that the country's strong economy and ability to borrow will prevent a collapse.

One of the main factors that would contribute to a collapse is a significant increase in interest rates, which would cause the government's debt payments to skyrocket. Additionally, if the government continues to borrow at an unsustainable rate, it could lead to a loss of confidence in the country's ability to pay back its debt, which could lead to a financial crisis.

However, it's important to note that the United States has a large and diversified economy, a stable political system, and the ability to borrow at low interest rates, which gives the country some cushioning against a collapse. Additionally, the country also has the ability to print money, which can help to stabilize the economy in times of crisis.

Furthermore, the World Bank and other international organizations have played a role in providing financial assistance to countries in need, which could help the US to avoid a collapse.

In conclusion, it's difficult to predict whether or not the United States will collapse due to high debt, as there are many factors at play. While the country's high debt levels do pose a risk, the country's strong economy, ability to borrow, and international support from organizations like the World Bank give it some cushioning against a collapse.